Entering the world of finance and investing can feel overwhelming, especially for newcomers. This glossary aims to simplify complex terms for beginners. It covers everything from basic finance concepts to investment jargon. By learning key terms, readers can make better financial decisions and reach their goals.

This guide covers personal finance basics, investment options, and tax planning. It’s perfect for anyone starting or deepening their financial knowledge. This glossary is your go-to resource for navigating the complex world of finance and investing.

Essential Financial Terms for Beginners

Getting into personal finance can seem tough, especially for newcomers. But, learning a few key terms can help you make better choices and control your money. Let’s explore the basics every beginner should know.

Understanding Assets, Liabilities, and Net Worth

Your financial health is shaped by your assets and liabilities. Assets are things you own that have value, like savings, investments, or property. Liabilities are your debts, such as your mortgage, credit card debt, or student loans. To find your net worth, subtract your liabilities from your assets. This shows your financial health and is key for planning your finances.

Decoding Income, Expenses, and Cash Flow

It’s also vital to grasp your income, expenses, and cash flow. Income is the money you make, from your job, investments, or other sources. Expenses are what you spend money on, like rent, bills, and food. Tracking your income and expenses helps you manage your cash flow. This lets you see where you can save money and make smarter choices about spending and saving.

Learning these basic finance terms is the first step to financial literacy. With this knowledge, you can start on your path to financial stability and success.

Demystifying Investment Terminology

Investing can seem complex, especially for beginners. We’ll simplify the basics of stocks, bonds, and mutual funds. This will help you understand these key financial tools.

Stocks: The Building Blocks of Ownership

Stocks let you own a part of a company. Buying stocks means you’re part of the company’s growth and success. You could see your investment grow and might get dividends, which are payments from the company.

Bonds: The Debt Instruments

Bonds let you lend money to companies or governments. They promise to pay you back with interest and the original amount later. Bonds are often seen as a stable choice, offering regular income.

Mutual Funds: Diversified Portfolios

Mutual funds collect money from many investors. They invest in various securities like stocks and bonds. This way, you get to try different investments, which can lower risk and improve returns over time. Experts manage mutual funds, making choices for all the investors.

Learning about stocks, bonds, and mutual funds is key to improving your investment glossary and financial literacy. Knowing their differences helps you make better choices for your investments.

“Successful investing is about managing risk, not avoiding it.” – Benjamin Graham

Navigating the World of Lending and Borrowing

It’s key to know the terms used in lending and borrowing to keep your finances healthy. This guide covers loans, interest rates, credit scores, and managing debt. It aims to help you use credit wisely and handle your debt well.

Loans: The Lifeline of Borrowing

Loans let people get money they don’t have right now. They come in types like mortgages, student loans, or personal loans. Knowing the loan’s terms is vital. Financial literacy helps you make smart choices and avoid problems.

Interest Rates: The Cost of Borrowing

Interest rates are what lenders charge for using their money. These rates change based on the loan type, your credit score, and the market. Understanding interest rates helps you make choices that save money.

Credit Scores: The Cornerstone of Borrowing

Credit scores show how likely you are to pay back a loan. A good score can get you better loan terms. So, it’s important to know about finance terms like credit scores.

Debt Management: Mastering the Balance

Debt management is about handling your debts well. It includes paying off debts, talking to creditors, and lowering your debt. Good financial literacy in this area brings financial stability and peace of mind.

| Loan Type | Interest Rate | Credit Score Range | Debt Management Strategies |

|---|---|---|---|

| Mortgage | 3.5% – 5.5% | 700 – 850 |

- Create a repayment plan

- Negotiate with creditors

- Consolidate debts

- Increase income to make payments

| Auto Loan | 4% – 7% | 650 – 800 |

- Prioritize high-interest debts

- Seek debt counseling services

- Establish an emergency fund

- Implement budgeting strategies

| Personal Loan | 6% – 36% | 600 – 850 |

- Negotiate with lenders

- Explore debt consolidation options

- Develop a debt repayment plan

- Monitor credit report regularly

Knowing key finance terms helps you handle lending and borrowing better. It lets you make choices that fit your financial goals.

Unraveling Tax Jargon for Savvy Financial Planning

Understanding taxes can seem tough, but knowing key terms helps you plan better. We’ll look into deductions, credits, and tax brackets. This will help you make smart choices and improve your finances.

Deductions and Credits: Unlocking Tax Savings

Deductions and credits are great for saving on taxes. Deductions lower what you owe in taxes, and credits reduce your tax bill directly. Knowing about common deductions like mortgage interest and charitable donations can cut your taxes. Also, learning about credits like the Earned Income Tax Credit can give you a financial boost.

Navigating Tax Brackets: Maximizing Your Earnings

Tax brackets are income levels taxed at different rates. Knowing your bracket helps you plan your income and investments to reduce taxes. Keeping up with tax laws and bracket changes ensures you pay the right amount of taxes.

| Tax Bracket | Taxable Income (Single Filer) | Tax Rate |

|---|---|---|

| 10% | $0 to $9,950 | 10% |

| 12% | $9,951 to $40,525 | 12% |

| 22% | $40,526 to $86,375 | 22% |

| 24% | $86,376 to $164,925 | 24% |

| 32% | $164,926 to $209,425 | 32% |

| 35% | $209,426 to $523,600 | 35% |

| 37% | Over $523,600 | 37% |

Learning these key financial terms boosts your financial literacy. It helps you make better decisions and feel confident about your taxes. Remember, knowing your stuff is key to managing your money well.

Finance and Investing: The Key to Financial Literacy

Learning about finance and investing is key to a secure future. It helps us make smart choices for our money. Financial literacy lets us handle personal finance well, leading to financial freedom.

Understanding financial terms is central to financial literacy. Knowing about assets, liabilities, cash flow, and investments is vital. This knowledge helps us make smart financial decisions that fit our goals.

Getting better at financial literacy takes time but is worth it. With this knowledge, we can manage our money well, plan for the future, and handle unexpected costs. Financial literacy is the first step to taking charge of our finances and securing a prosperous future.

“Financial literacy is the ability to understand how money works in the world – how someone manages to earn or make it, how that person manages it, how he/she invests it (turn it into more) and how that person donates it to help others.” – Robert Kiyosaki

As we delve deeper into finance and investing, let’s remember that understanding the basics is the first step. With this knowledge, we can confidently make smart choices and secure a brighter future.

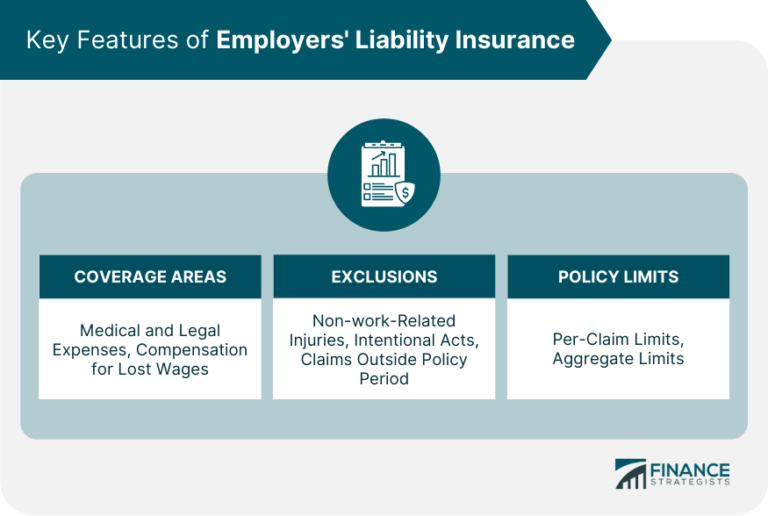

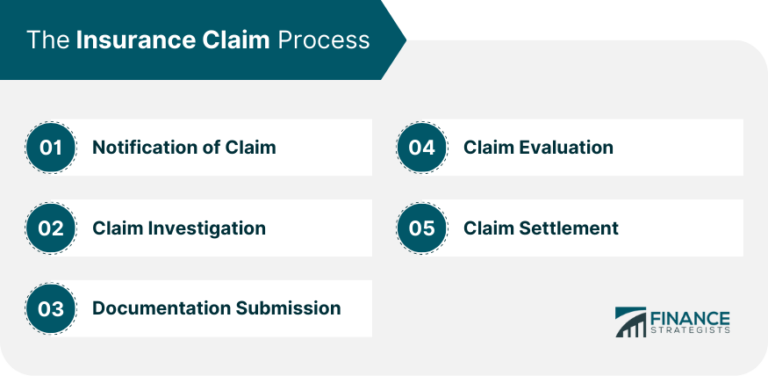

Risk Management: Safeguarding Your Financial Future

Risk management is key to long-term financial stability in personal finance. It helps protect your assets and secure your financial future. Diversification and insurance are two main parts of this strategy.

Diversification: Spreading Your Risks

Diversification means investing in different assets to lower your risk. By spreading your money across stocks, bonds, and real estate, you lessen the effect of one investment doing poorly. This way, your financial health isn’t just tied to one asset or market.

Insurance: Protecting Against the Unexpected

Insurance is vital for risk management, covering unexpected costs that could hit hard financially. It includes health, life, home, and auto insurance. Having the right insurance means you’re not alone when unexpected things happen, helping to lessen the financial blow.

Emergency Funds: Preparing for the Unexpected

Building an emergency fund is also crucial for risk management. It’s a cash reserve for sudden expenses like medical bills or car repairs. Aim to save enough for three to six months of expenses, giving you a financial safety net during tough times.

Using these strategies, you can protect your financial future and feel more secure. Learning about finance and risk management is key to handling the complex world of finance terms and building a strong financial base.

| Risk Management Strategy | Benefits |

|---|---|

| Diversification | Reduces the overall risk of your investment portfolio |

| Insurance | Provides financial protection against unexpected events |

| Emergency Fund | Offers a financial safety net for unexpected expenses |

Retirement Planning: Securing Your Golden Years

Planning for retirement is key to a secure future. It’s important to know about financial literacy. Learning about finance terms and retirement planning can help you reach your financial goals.

Starting with employer-sponsored retirement accounts like 401(k)s is a good step. These plans let you save money before taxes are taken out. Plus, many employers match your contributions, which can increase your savings.

Individual Retirement Accounts (IRAs) are also vital for planning. They come in traditional and Roth types. Traditional IRAs grow tax-deferred, while Roth IRAs offer tax-free withdrawals later. Choosing the right IRA is a big part of financial literacy.

Pensions are less common but still important for retirement planning. They offer a steady income in retirement, adding to your savings and investments.

A good retirement plan combines finance terms, investment strategies, and tax advice. With the right knowledge and a financial advisor, you can secure your financial future. This way, you can enjoy the retirement you’ve earned.

“Retirement is the time to enjoy the fruits of your labor and create a legacy for future generations.” – Anonymous

Deciphering Accounting and Bookkeeping Terms

Understanding finance means knowing key accounting and bookkeeping terms. We’ll look at important words like balance sheets, income statements, and cash flow statements. These terms are the foundation of financial reports.

Balance Sheets, Income Statements, and Cash Flow Statements

A balance sheet shows a company’s financial state at a certain time. It lists assets, liabilities, and equity. This helps show the company’s financial health.

The income statement tracks revenue, expenses, and net income over time. It’s usually for a quarter or a year. The cash flow statement shows how cash moves in and out of the business. It highlights where cash comes from and goes to during a period.

Knowing these financial statements is key for finance terms and financial literacy. They help people make smart choices about investments, loans, and financial planning. Whether you own a business, invest, or just want to manage your money better, understanding these concepts is vital.