Managing large purchases can feel overwhelming in personal finance. Whether it’s a new home, a car, or a big appliance, having a solid plan is key. This guide offers tips to help you make smart choices and reach your financial goals.

Start by budgeting for big items. Make a savings plan and track your spending to keep your purchases in check. Look into loans or leases to find the best fit for you.

Having an emergency fund is vital for unexpected costs. Figure out how much you need based on your finances for peace of mind.

Debt management and understanding interest rates are crucial for large purchases. Set your financial goals and spend wisely for a secure future.

Insurance is crucial for big buys. Make sure you have enough coverage to protect your investment and be ready for surprises.

Knowing how taxes affect large purchases is important for your finances. Learn about tax laws to save more and pay less in taxes.

Improving your negotiation skills can save you a lot on big items. Research, compare prices, and use your bargaining power to get the best deals.

Budgeting for Big-Ticket Items

Creating a solid budgeting plan is key for big purchases. A savings plan and expense tracking help you save for these items. This way, you won’t spend more than you can afford.

Creating a Savings Plan

Start by making a savings plan. Figure out how much your item costs and set aside money each month. Automate your savings to grow your funds over time.

Tracking Expenses

Keep an eye on your spending with a savings plan. This helps you find ways to spend less and save more for your big purchase. By watching your spending, you can make smart choices and stick to your budgeting goals.

| Expense Category | Monthly Average | Potential Savings |

|---|---|---|

| Dining Out | $250 | $100 |

| Entertainment | $150 | $50 |

| Groceries | $400 | $75 |

| Total Potential Savings | $225 |

Use these budgeting tips to save for big purchases without overspending. Keep an eye on your finances and remember, every little bit helps in reaching your goals.

Financing Options for Large Purchases

Buying something big like a new car, home, or a major appliance can be expensive. The choice of financing can greatly affect the cost and how affordable it is. Looking into different financing options helps people make smart choices for their money.

Personal loans are a common way to finance large purchases. You can get these from banks, credit unions, or online lenders. They give you a big sum of money that you pay back in fixed monthly payments over time. These loans usually have good interest rates and flexible payback plans, making them a good choice for those who like a clear payment plan.

Leasing is another way to get what you need without buying it outright. With leasing, you use the item for a certain time and pay less each month than buying it. It’s great for those who want the newest items or don’t want to own something for a long time.

| Financing Option | Pros | Cons |

|---|---|---|

| Personal Loan |

- Fixed monthly payments

- Competitive interest rates

- Flexible repayment terms

- Requires a credit check

- May have origination fees

| Leasing |

- Lower monthly payments

- Ability to upgrade to newer models

- No ownership at the end of the lease

- Mileage and wear-and-tear restrictions

When looking at financing options for large purchases, think about the interest rate, how long you’ll pay back, any extra fees, and the total cost of the loan. By looking at the good and bad of each option, you can choose the best one for your money goals and budget.

The Importance of an Emergency Fund

Having a strong emergency fund is key to good financial planning. It acts as a safety net for sudden costs that could throw off your budget. Setting aside part of your income for emergencies means you’re ready for surprises without risking your financial future.

Calculating Your Emergency Fund Needs

How much you should save for emergencies varies by your situation. Aim to have enough for three to six months of basic living costs. This includes rent, utilities, food, and other must-haves. Knowing this helps set a realistic savings goal.

To figure out how much you need, follow these steps:

- Write down your monthly must-haves, like rent and groceries, but not extras.

- Multiple this by the number of months you aim to save for (usually 3-6 months).

- This is the amount you should aim to save in your emergency fund.

| Expense Category | Monthly Cost |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities (electricity, water, internet) | $250 |

| Groceries | $400 |

| Car Payment | $300 |

| Car Insurance | $100 |

| Total Essential Monthly Expenses | $2,250 |

For the expenses shown, a 6-month fund would be $13,500 (6 months x $2,250 monthly expenses).

Building an emergency fund helps reduce the financial stress of unexpected costs. It keeps your financial future stable and lets you make smart choices about big buys.

Personal Finance: Strategies for Debt Management

Managing debt is key in personal finance, especially when buying big things. Knowing how interest rates work and using smart debt management can help. This way, people can pay off debt faster and reach their financial goals.

Understanding Interest Rates

Interest rates greatly affect the cost of debt over time. High rates make paying off debt harder. On the other hand, low rates can help reduce the borrowing cost. Keeping up with interest rates and talking to lenders can lead to better financing choices.

Let’s look at an example to see how interest rates work:

| Loan Amount | Interest Rate | Loan Term | Total Interest Paid |

|---|---|---|---|

| $50,000 | 5% | 10 years | $12,725 |

| $50,000 | 10% | 10 years | $27,208 |

The table shows how a higher interest rate can increase the total interest paid. This underlines the need to understand and manage interest rates well.

To manage debt well, focus on high-interest debt, talk to lenders, and make a solid repayment plan. These steps help reduce the long-term financial effects of debt.

Prioritizing Financial Goals

Setting and focusing on financial goals is key to handling big buys. Whether it’s for a new house, a fancy car, or a dream trip, matching your spending with your financial plans is vital. This helps you stay financially stable and reach your goals.

First, figure out your short-term and long-term financial aims. Short-term goals might be saving for emergencies or paying off high-interest debt. Long-term goals could be saving for retirement or your kids’ education.

- Determine your short-term financial goals (e.g., emergency fund, debt repayment).

- Identify your long-term financial goals (e.g., retirement, education savings).

- Prioritize your goals based on their importance and timeline.

- Allocate your resources (income, savings) to align with your prioritized financial goals.

- Review and adjust your goals regularly to ensure they remain relevant and achievable.

By focusing on your financial goals, big purchases like a new home or car fit into your financial plan. This way, you make smart choices, don’t spend too much, and reach your financial goals.

| Short-Term Goals | Long-Term Goals |

|---|

- Build an emergency fund

- Pay off high-interest debt

- Save for a down payment

- Retirement planning

- Fund children’s education

- Save for a vacation home

Remember, everyone’s financial goals are different. So, make sure your plan fits your unique situation. By focusing on your financial goals, you can make smart choices and control your financial future.

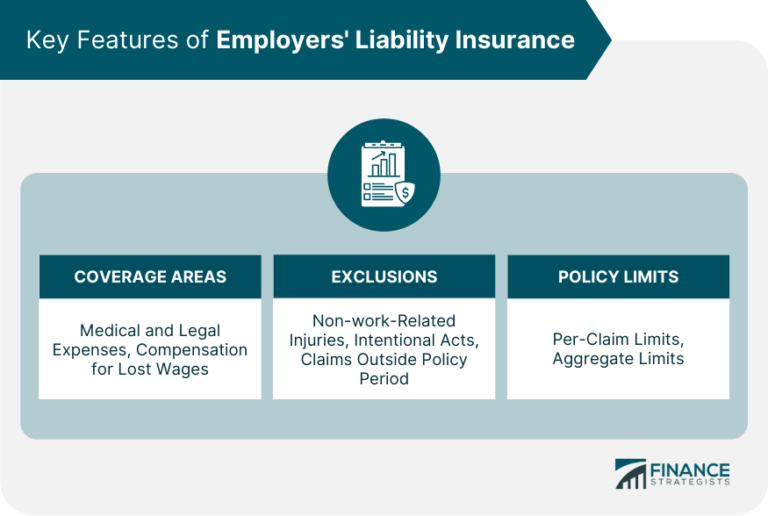

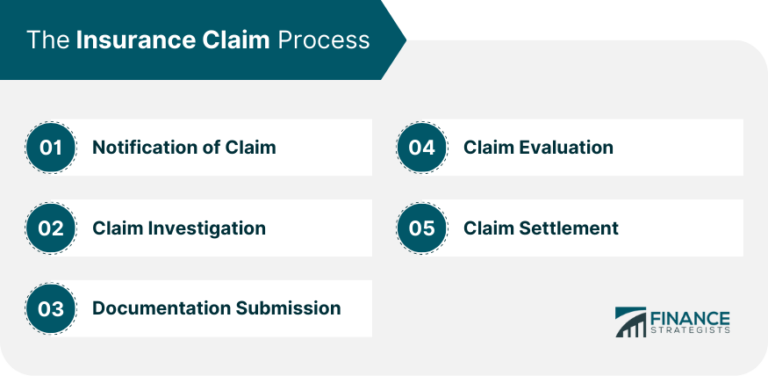

The Role of Insurance in Major Purchases

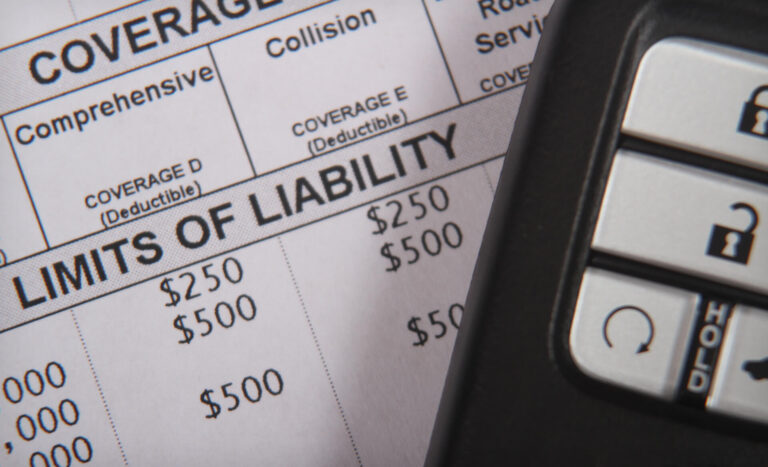

Protecting your big buys, like a home or a car, is key. Having the right insurance can protect you from financial risks. This section will cover the types of insurance you should think about and how to pick the right level of protection for your big buys.

Evaluating Insurance Coverage

When you make a big purchase, it’s vital to look at insurance options carefully. The type of purchase you make might need different insurance for full protection. Here are some important points to consider:

- For a home, you need homeowner’s insurance to cover damages, theft, and liability.

- Buying a car requires auto insurance with liability, collision, and comprehensive coverage.

- For some big buys, you might need special insurance like life or disability insurance to protect your family’s finances.

Make sure to check the coverage limits and deductibles to get the right protection for your major purchases. You might want to compare quotes from different insurers to find the best deal.

By looking at your insurance needs and getting the right coverage, you can rest easy knowing your insurance has you covered for unexpected events.

Tax Implications of Large Purchases

When you buy something big, think about the taxes. The taxes you pay can change based on what you buy and your finances. Knowing about these taxes can help you make better choices and get the most from your money.

For example, the interest on your mortgage might be tax-deductible if you buy a new home. This can save you a lot of money at tax time. Also, the sales tax on a car might be deductible, depending on where you live.

But, some big buys can lead to surprise taxes. Buying a vacation home or an investment property might mean extra taxes. These could be capital gains tax or depreciation recapture. Always talk to a tax expert before buying something big to know the tax rules.

Knowing about the taxes on big buys helps you plan better and save money. By thinking ahead and understanding taxes, you can make your investments work harder for you. This means a more secure financial future.

“Careful planning and understanding of the tax implications of large purchases can lead to significant long-term savings.”

Tax laws and rules can change, so it’s important to keep up. Always talk to a tax expert to make sure you’re making smart choices with your big buys.

Negotiating Prices for Big-Ticket Items

When buying something big like a new car or a top-notch appliance, negotiating can save you a lot of money. First, look up the market value of what you want to buy online or get advice from experts. This helps you know what’s a fair price and where you might be able to negotiate.

Timing is key in negotiating. Watch for sales, promotions, or times when demand is low. This could mean you can get a better deal. Also, use other sellers’ offers to make your case stronger.

Good negotiation is a skill you can get better at. Be confident, respectful, and open to different options. With these tips, you might get the best price for your big buys.